Bull of the Day: Taiwan Semiconductor (TSM)

Taiwan Semiconductor Manufacturing Company TSM is arguably the most important technology firm in the world, making it one of the most surefire buy-and-hold stocks on Wall Street.

TSMC is by far the largest semiconductor manufacturer, capturing around a 90% share of all advanced chip manufacturing. Artificial intelligence innovation and technological growth would come to a halt without Taiwan Semi, which is why it’s actively and aggressively expanding outside of Taiwan to address geopolitical concerns.

Check out the Zacks Earnings Calendar to stay ahead of market-moving news.

Market-movers across tech, from Nvidia to Apple, rely on Taiwan Semi to physically build their most cutting-edge chips for AI and everything else.

The chip maker’s earnings outlook has soared since its Q4 release on January 15 to land Taiwan Semi a Zacks Rank #1 (Strong Buy). TSMC is projected to more than double its sales and earnings between 2024 and 2027 as the AI arms race heats up.

Image Source: Zacks Investment Research

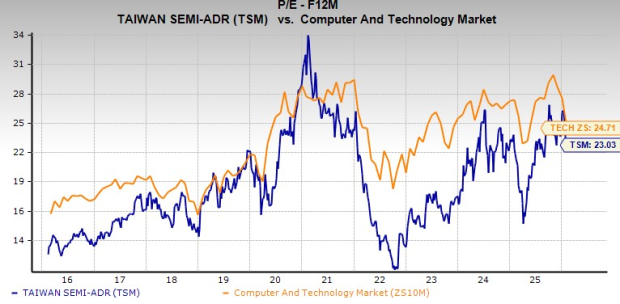

TSM stock has crushed the Zacks Tech sector over the past 20 years and the last 12 months. The AI chip maker also stayed above the fray of the recent AI-driven selloff over the last week.

Despite climbing 67% in the past year and trading right near its all-time highs, TSMC’s average Zacks price still offers 23% upside from its current levels.

To top it all off, Taiwan Semi pays a solid dividend, supported by its stellar balance sheet, and it offers solid value compared to the Tech sector, while trading at a 33% discount to its own peaks.

Buy AI Chip Stock TSMC Now and Hold Forever

Taiwan Semi physically builds and manufactures semiconductors. TSMC, therefore, consistently benefits from broad-based technological growth and innovation because chips are the lifeforce behind nearly all technologies, including AI.

The $1.8 trillion market cap powerhouse is poised to be a long-term AI and technology winner, no matter how the technologies evolve and disrupt the economy. TSMC also stands to grow even as the forward-facing AI companies ebb and flow in the coming decades.

It is not a stretch to say that Taiwan Semi has one of the best chances at remaining a titan of tech 20 years from now compared to any of the Mag 7, since it is the most critical, high-tech picks-and-shovels tech stock of all time.

Image Source: Zacks Investment Research

Nvidia NVDA entrusts Taiwan Semi to manufacture its most sophisticated AI chips, as do other tech innovators and Mag 7 companies. TSMC is boosting its industry-leading 3-nanometer production as Nvidia and other AI chip firms ramp up shipments to fuel the multi-trillion-dollar AI arms race that shows little signs of slowing down.

Shipments of its most advanced 3-nanometer chips accounted for 28% of TSMC’s Q4 wafer revenue, up from 23% in Q3. So-called advanced technologies (“7-nanometer and more”) made up 77% of total wafer revenue last period.

Why Taiwan Semi is One of the Best Tech Stocks to Buy

Warren Buffett and finance professors might use Taiwan Semi as a prime example of creating a nearly impenetrable moat around a business, which is key to long-term success for businesses and investing.

Taiwan Semi reportedly holds a 60% share of the entire foundry market and 90% of advanced chip manufacturing. It’s almost peerless, and likely will be for the foreseeable future, given the decades of internal expertise, human and physical capital, and more required to manufacture the most advanced semiconductors.

TSMC is rapidly addressing one of its only real potential setbacks: geopolitical turmoil.

The company is expanding its manufacturing footprint outside Taiwan. TSMC has announced commitments of $165 billion to build additional chip manufacturing plants in Arizona. This is part of TSMC's long-term effort to build a large-scale manufacturing base in the U.S.

Image Source: Zacks Investment Research

The chip maker is also quickly building out its fabrication efforts in Japan, with it set start producing its most advanced 3-nanometer chips in Japan for the first time, according to a February 5 Wall Street Journal report. Taiwan Semi is reportedly looking at building plants in Germany and the United Arab Emirates as well.

TSMC’s AI-Boosted Growth Outlook Cements its Bull Case

TSMC averaged ~27% revenue growth between FY20-FY24 (not including its -4% YoY decline in 2023). It posted impressive earnings expansion during this stretch as well, outside of the FY23 dip against a tough-to-compete-against boom.

The company kicked off Q4 2025 earnings season with a bang on January 15, confirming the AI boom remains full steam ahead. TSMC expects it will grow its revenue by 30% in 2026 as part of a CAGR of ~25% from 2024 to 2029. It also raised its 2026 capex guidance to between $52 billion and $56 billion, blowing away 2025's $40.9 billion.

Taiwan Semi is projected to grow its revenue by 29% in FY26 based on Zacks estimates, with 25% sales expansion expected next year to climb from $122 billion in 2025 to $198 billion in FY27—easily doubling its 2024 sales ($88 billion).

Image Source: Zacks Investment Research

On the earnings front, Taiwan Semi is projected to grow its EPS by 33% in 2026 and 24% in 2027 to reach $17.55 a share, vs. $10.65 in 2025 and $7.04 in 2024. This outlook extends its stellar run of earnings growth that kicked off over the past five years.

TSMC’s earnings estimates soared since its release to land the stock its Zacks Rank #1 (Strong Buy), with its FY26 estimates 16% higher and its FY27 estimate up 23%.

TSM stock climbed 13% YTD vs. Tech’s 3% drop and Nvidia’s 1% fall. The chip builder has crushed all of the Mag 7 to start 2026 to help it outperform those seven tech giants over the last two years, up 180%. TSMC’s roughly 1,500% climb over the last decade saw it outperform five of the Mag 7 stocks, lagging only Tesla and Nvidia.

The stock has soared 3,600% over the last 20 years, more than quadrupling the tech sector. TSM is trading right near its all-time highs, yet its average Zacks price target still offers 23% upside to its current price.

TSM might be ready to break out into a new trading range based on the chart above. At the same time, the AI chip maker looks a bit overheated on a 20-year timeframe. Some investors might want to start a position in the stock now and then add to it the next time it experiences a larger pullback.

Image Source: Zacks Investment Research

On the valuation front, Taiwan Semi trades at a 33% discount to its 10-year highs at 23X forward 12-month earnings. The chip maker also trades at a 7% discount to the Tech sector despite its near-term and long-term outperformances.

Wall Street is paying more attention to TSMC stock these days as well. We now have 17 brokerage recommendations for the stock, up from 13 three months ago, with 14 “Strong Buys,” two “Buys,” and one “Hold.” The well-run company pays a dividend, and its balance sheet keeps getting better and better, with its Shareholders' Equity up roughly 170% since 2020.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com