Bear of the Day: JD.com (JD)

JD.com Company Overview

Based in Beijing, Zacks Rank #5 (Strong Sell) stock JD.com (JD) one of the largest Chinese e-commerce and technology companies. Also known as Jingdong, JD.com separates itself from the competition by being an essentially vertically integrated e-commerce retailer. JD holds its own inventory, is responsible for its own logistics and deliveries, and provides its own customer service. JD is similar to Amazon (AMZN) in that it sells a wide variety of products on its e-commerce platform, including clothing, groceries, electronics, and more. Beyond e-commerce, JD also operates health, technology, real estate, and industrial segment businesses. Additionally, JD owns Ochama, a European-based retail brand with operations in the Netherlands France, and Poland.

JD Suffers from Relative Price Weakness Vs. Peers

Legendary growth investor William O’Neil once proclaimed that Wall Street’s great paradox is, “Stocks that seem too high in price and risky for most investors usually go higher and stocks that seem low and cheap often go lower.” I have largely discovered that more often than not, O’Neil’s paradox comes to fruition. That’s bad news for JD shares, which trade at $30 and are well off their all-time high of >$100. Additionally, relative price action can provide investors with valuable clues. Currently, JD shares exhibit troubling relative weakness and are -15.02% over the past year, far underperforming top competitors like Pinduoduo (PDD) and Alibaba (BABA) which are up 20.76% and 83.76% respectively.

Image Source: TradingView

JD: Slowing Sales Growth

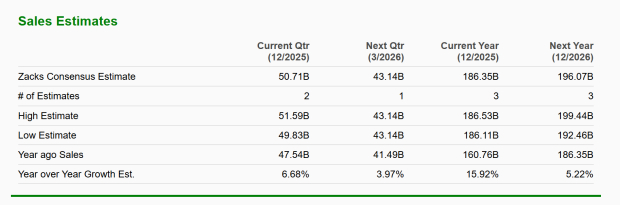

JD sales growth is declining at an alarming rate. For the current quarter, Zacks Consensus Analyst Estimates suggest that earnings growth will be just 6.68%%. Meanwhile, Zacks Consensus Estimates suggest sluggish annual revenue growth of 5.22% in 2026.

Image Source: Zacks Investment Research

JD Food Delivery Business is a Headwind

JD is making an aggressive play for the Chinese food delivery market. While the number of users for the company’s Uber (UBER) Eats or DoorDash (DASH) like business has increased, the segment has produced significant losses thus far. Worse still, the company must invest significant capital maintain its reputation for fast and reliable delivery in a highly competitive market.

Bottom Line

JD.com currently face a difficult uphill battle. Between alarming slowdowns in growth and the financial strain of expansion into the competitive food deliver market, JD’s “cheap” share price may be warranted.

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the "first wave" of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks' AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

JD.com, Inc. (JD): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

PDD Holdings Inc. Sponsored ADR (PDD): Free Stock Analysis Report

Uber Technologies, Inc. (UBER): Free Stock Analysis Report

DoorDash, Inc. (DASH): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com