Bull of the Day: Eli Lilly (LLY)

Eli Lilly Company Overview

Zacks Rank #1 (Strong Buy) Eli Lilly and Company (LLY) is one of the world’s largest and most diversified pharmaceutical companies. The Indiana, Indianapolis-based company offers a pharma product category that includez neuroscience (Cymbalta/Emgality), cardiometabolic health (Mounjaro, Zepbound, Trulicity, and others), oncology (Alimta, Cyramza, and Verzenio), immunology (Taltz, Omvoh, and Olumiant), and erectile dysfunction (Cialis). LLY has grown and continues to grow its business through key acquisitions, including Hypnion (a neuroscience drug discovery company focused on sleep disorders), CoLucid Pharmaceuticals (which offers acute migraine treatments), Loxo Oncology (which has cancer drugs), and several others. Additionally, Lill has collaboration agreements with several pharma companies, such as Incyte (INCY) and Roche (RHHBY).

Obesity: The Biggest Blockbuster Drugs Ever

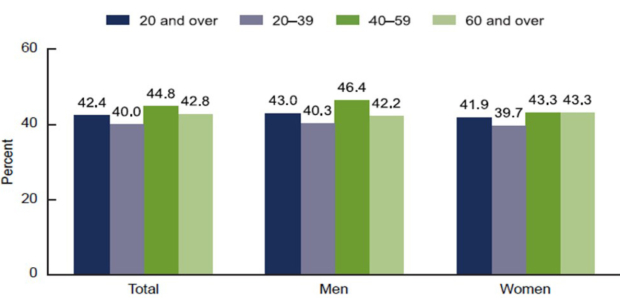

One of the best pieces of advice that an entrepreneur can get is to solve problems. If an entrepreneur can solve a significant problem that a swath of people suffer from, the money will come. In the United States, no bigger problems exist than obesity and the adverse complications that come with it. In fact, according to the National Institute of Health (NIH), nearly 1 in 3 adults (30.7%) are overweight, and more than 2 in 5 adults (42.4%) have obesity.

Image Source: NIH

Mounjaro and Zepbound include the same compound, tirzepatide, a dual GIP and GLP-1 receptor agonist (GIP/GLP-1 RA). The GLP-1 segment is a very important class of drugs for multiple cardiometabolic diseases and is gaining significant popularity. Mounjaro was approved in May 2022 for the treatment of type II diabetes. Zepbound was launched in November 2023 for patients with obesity or overweight with weight-related comorbidities. Despite being on the market for such a short time, Mounjaro and Zepbound have become key top-line drivers for Lilly, with demand rising rapidly. Mounjaro and Zepbound generated combined sales of $16.5 billion in 2024, accounting for around 36% of the company’s total revenues.

Year to date, the drugs generated combined sales of $24.8 billion, comprising around 54% of the company’s total revenues. Launches of Mounjaro and Zepbound in new international markets and improved supply from ramped-up production in the United States have led to strong sales growth in 2025. The positive trend is expected to continue in 2026. Our estimates for Mounjaro and Zepbound suggest a CAGR of 44.6% and 73.7%, respectively, over the next three years. Meanwhile, in addition to Mounjaro and Zepbound, Lilly is investing broadly in obesity and has several new molecules currently in clinical development with a range of oral and injectable medications with different mechanisms of action.

Lilly Inks Obesity Drug Deal with Trump Administration

LLY has inked a deal with the Trump Administration to provide wider access to obesity drugs through the “TrumpRX” platform. The new “BALANCE” program will allow Medicare and Medicaid to cover GLP-1s for obesity with lower co-pays ($50/month) starting in 2027. These incentives should help to drive hot obesity drug sales even further.

New Drugs, Future Pipeline will Continue to Drive Growth

In addition to Mounjaro and Zepbound, Lilly has received approvals for other new drugs in the past couple of years. Omvoh/mirikizumab was approved for its first inflammatory bowel disease (IBD) indication, ulcerative colitis, in the United States, Europe and Japan in 2023 and for its second IBD condition, Crohn's disease, in the United States, Europe, and Japan in 2025. Additionally, Lilly has been building its pipeline and has a wide range of compounds in various stages of development.

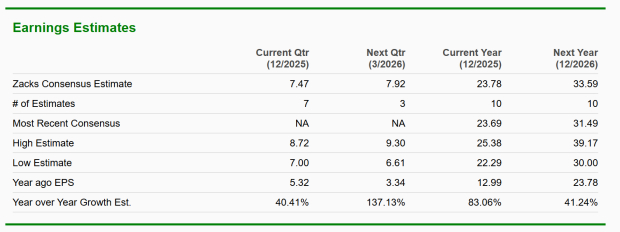

Zacks Consensus Analyst Estimates expect robust EPS growth of 41.24% in 2026. LLY, which recently crossed the $1 trillion market cap landmark, will continue to attract institutional investors, as the company has the rare and coveted combination of rapid growth and underlying liquidity.

Image Source: Zacks Investment Research

LLY Bounces off the Rising 10-Week MA

Beyond fundamentals, LLY’s price action is also bullish. LLY shares are bouncing off the rising 10-week moving average for the first time since breaking out in late 2025, offering investors a high reward-to-risk entry point.

Image Source: TradingView

Bottom Line

Eli Lilly has solidified its position as a global pharma titan. With leading drugs and a massive obesity market, Lilly is poised to be a juggernaut for years to come.

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the "first wave" of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks' AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

Incyte Corporation (INCY): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com