Bear of the Day: LGI Homes (LGIH)

Despite the broader stock market’s strength and a persistently resilient US economy, the housing sector has been a notable laggard over the past year. Elevated interest rates and an ongoing correction from the excesses of the post-COVID housing boom have materially cooled demand across many regional markets, weighing on both volumes and affordability.

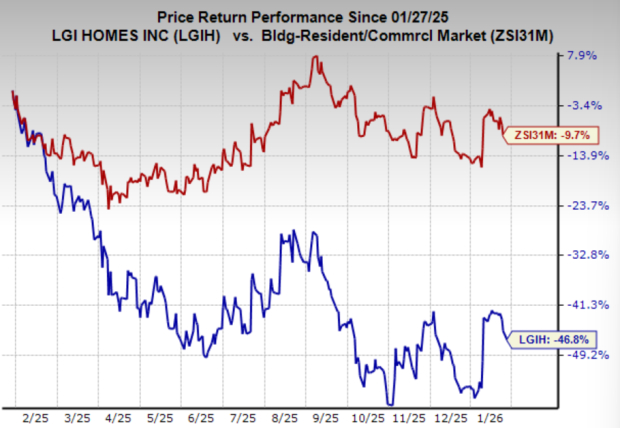

LGI Homes (LGIH) has fared particularly poorly in this environment, underperforming even the already weak homebuilding group. The company’s exposure to first time buyers leaves it especially vulnerable to affordability pressures, as higher mortgage rates and home prices disproportionately impact entry level demand. As a result, both the share price and earnings outlook have deteriorated, with sales growth trending lower over the past several years, pointing to a materially negative outlook.

Until affordability pressures ease meaningfully or demand from first time buyers shows clear signs of recovery, LGI Homes remains exposed to an unfavorable environment. With sales trends deteriorating, earnings under pressure, and the housing sector still facing headwinds, investors may be better served seeking opportunities elsewhere in areas of the market.

Image Source: Zacks Investment Research

LGI Homes Shares Decline Amid Continued Downgrades

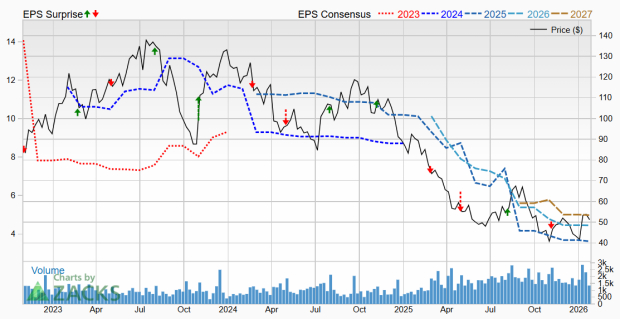

Falling earnings estimates, declining sales, and sustained share price weakness have weighed heavily on LGI Homes shareholders. The stock currently carries a Zacks Rank #5 (Strong Sell) rating, reflecting ongoing downward earnings revisions that have now endured for nearly two years.

Sales have been in a clear downtrend for the past four years, and analysts expect conditions to worsen further in the year ahead. Revenue is projected to decline another 21%, extending a contraction that has already been severe. After peaking near $3 billion, annual revenue is now expected to fall to approximately $1.74 billion, underscoring the depth and persistence of the slowdown facing the business.

Image Source: Zacks Investment Research

Tactical Outlook for LGIH Stock

LGI Homes shares have been in a pronounced downtrend over the past two years. While the stock appeared to be forming a potential bottom in the fall of last year, that rally proved short-lived, with prices selling off sharply into the start of this year. A subsequent rebound in early January again stalled at the same resistance level seen in December, reinforcing the significance of that ceiling.

This repeated failure at resistance is a negative technical signal and leaves the stock vulnerable to a retest of lower support. Shares may attract buyers near the $43 level, but even that support remains uncertain as rising interest rates continue to pressure housing related equities and dampen investor appetite for the group.

Image Source: TradingView

Should Investors Avoid LGIH Stock?

With earnings estimates still moving lower, sales trends deteriorating, and the stock locked in a persistent downtrend, LGI Homes offers limited near-term appeal. Until affordability improves and demand from first time buyers shows clear signs of recovery, the risk-reward profile remains unfavorable, suggesting investors are better served looking elsewhere for more attractive opportunities.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

LGI Homes, Inc. (LGIH): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com