Bull of the Day: Amphenol (APH)

There is ongoing debate about how transformative artificial intelligence will ultimately prove to be. Questions around monetization, productivity gains, and long-term economic impact remain open. What is not debatable, however, is the scale of capital already being deployed to support AI workloads. Hyperscalers and enterprise customers alike are committing unprecedented sums to data center infrastructure, and that investment is flowing directly into the physical components required to build, power, and connect those facilities.

The sheer scale of today’s data center buildout is difficult to overstate. Facilities that once consumed tens of megawatts are now being deployed at 300 to 500 megawatts per site, with multiple hyperscalers actively expanding campuses toward one to two gigawatts of total capacity, power levels comparable to those of large cities.

Just as striking as the size is the pace. Projects are scaling so quickly that sites commissioned only months ago are already being leapfrogged by new builds, as operators race to bring capacity online. Each incremental megawatt added requires exponentially more high-speed connectivity, cabling, and interconnect hardware. With an estimated ~33% share in key AI-driven datacom connectivity segments, Amphenol (APH) sits directly at the center of this infrastructure arms race.

But beyond AI infrastructure, Amphenol is also exposed to a second, powerful macro tailwind: sustained growth in global defense spending. Across aerospace, military, and harsh-environment applications, the company has built a dominant position supplying mission-critical interconnect systems where reliability and performance are non-negotiable. This diversification provides an additional layer of earnings durability and reduces reliance on any single end market.

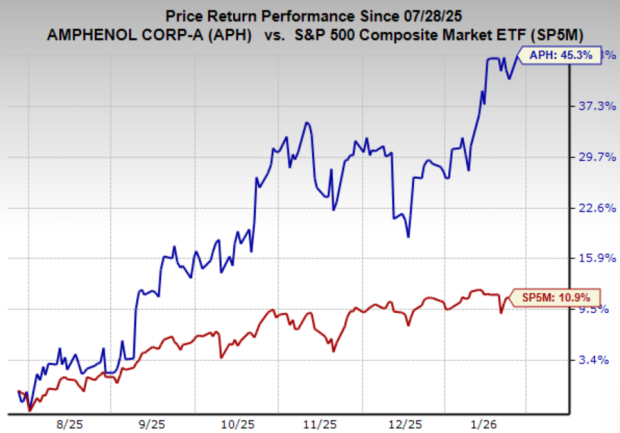

Not surprisingly, Amphenol carries a top Zacks rating and continues to exhibit strong price momentum. Importantly, even after significant share price appreciation, the stock still trades at a valuation that remains reasonable relative to its growth outlook. With multiple secular drivers reinforcing one another, Amphenol appears well positioned to deliver continued earnings expansion going forward.

Image Source: Zacks Investment Research

Amphenol Shares Gain on Earnings Upgrades

Growth, upward earnings revisions, and a still-reasonable valuation underpin Amphenol’s current, and increasingly durable investment appeal. The stock currently enjoys a Zacks Rank #1 (Strong Buy) rating, reflecting a steady stream of earnings upgrades that has persisted for nearly two years, a signal of improving fundamentals and analysts underestimation of future growth.

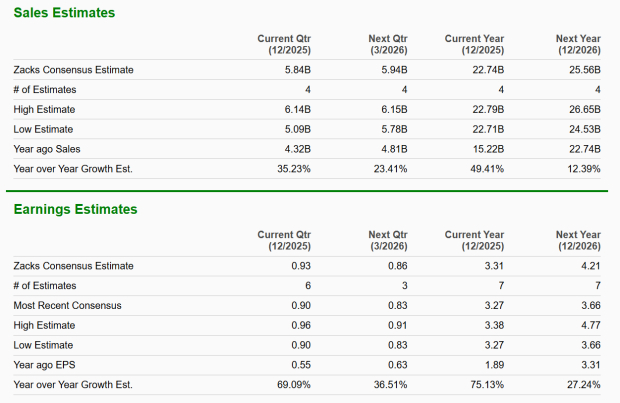

Revenue growth is projected to accelerate sharply in the near term, with the top line expected to rise 49.4% this year before moderating to 12.4% next year. Even those estimates may prove conservative, because of those underestimations and duration of Amphenol’s growth in recent cycles. Earnings growth is even more compelling, with EPS forecast to climb 75.1% this year and 27.4% next year, driven by operating leverage and sustained demand across datacom and defense end markets.

At roughly 35.9x forward earnings, Amphenol does not especially cheap. However, valuation looks far more attractive when viewed through a growth adjusted lens. With EPS expected to compound at approximately 39.1% annually over the next three to five years, the stock trades at a PEG ratio below 1, suggesting a discount to growth based on the metric.

Image Source: Zacks Investment Research

Amphenol Stock on the Verge of Another Breakout

Amphenol shares have trended steadily higher over the past two years, punctuated by periods of consolidation followed by decisive breakouts. After clearing another consolidation range at the start of this year, the stock is now forming a tidy bullish continuation pattern, suggesting the broader uptrend remains intact.

A sustained move above the $156 level would likely attract renewed buying interest and could set the stage for another leg higher. Conversely, a failure to hold above $150 may indicate the need for additional consolidation before the next advance. In that scenario, even with strong underlying fundamentals, more patient investors may find a better risk-reward entry point following a pullback or base building phase.

Image Source: TradingView

Should Investors Buy Shares in APH?

Amphenol offers a rare combination of powerful secular tailwinds, accelerating earnings growth, and favorable technical momentum. The company is directly leveraged to massive AI infrastructure spending while also benefiting from sustained strength in defense and aerospace markets. With earnings estimates still moving higher, valuation remaining reasonable and the stock approaching another potential technical breakout, Amphenol appears well positioned for continued upside despite its strong run over the last couple of years.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amphenol Corporation (APH): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com