Bear of the Day: Qualcomm (QCOM)

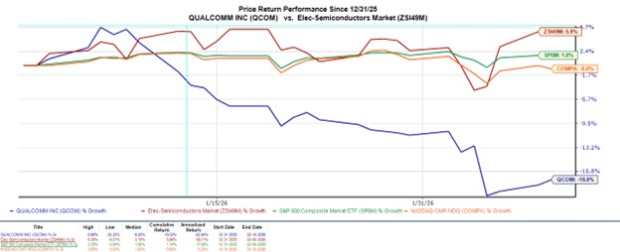

Qualcomm QCOM shares are down 5% since its fiscal first quarter report last Wednesday, and have now fallen nearly 20% year to date.

Even though Qualcomm exceeded quarterly expectations, its guidance came in below Wall Street's estimates, attributed to the well-documented memory chip shortage.

Despite record Q1 sales, a cautious tone surrounding the shortage from Qualcomm’s management has weighed on investor sentiment and analysts' outlook for the stock.

Triggering a Zacks Rank #5 (Strong Sell), Qualcomm is experiencing an unfavorable trend of declining EPS revisions, and lands the Bear of the Day.

Image Source: Zacks Investment Research

The Global Memory Chip Shortage

Qualcomm has emphasized that memory chip shortages are hurting smartphone demand, which directly impacts its core handset processor business.

The company has warned that original equipment manufacturers (OEMs) are pulling back on orders due to memory constraints, which is expected to weigh on sales in the near term.

While investors love upstream suppliers during a shortage that can raise prices, such as storage and flash-chip memory providers, like Sandisk SNDK and Western Digital WDC, they typically avoid downstream component providers in the supply chain, like Qualcomm, which designs processors and modems that go into the finished devices.

In other words, upstream suppliers sell the scarce resource; downstream suppliers depend on it.

Weak Guidance & Declining EPS Revisions

Qualcomm’s Q2 revenue guidance of $10.2–$11 billion missed the consensus estimates of $11.1 billion. More concerning, Q2 EPS guidance of $2.45–$2.65 was well under the Zacks Consensus of $2.85.

Suggesting more downside risk ahead is that over the last 30 days, Qualcomm's fiscal 2026 and FY27 EPS estimates have now dropped over 7%, following a noticeable decline in the last week.

Image Source: Zacks Investment Research

Bottom Line

Ironically, skyrocketing demand for AI data centers has diverted memory supply away from smartphones, causing OEM production delays and forcing Qualcomm to lower its guidance.

Although Qualcomm has AI data center endeavors of its own, smartphone production is still its biggest revenue source. Until there is a resolution to the memory chip shortage, it wouldn't be surprising if there is more volatility ahead for Qualcomm stock.

Zacks' Research Chief Picks Stock Most Likely to "At Least Double"

Our experts have revealed their Top 5 recommendations with money-doubling potential – and Director of Research Sheraz Mian believes one is superior to the others. Of course, all our picks aren’t winners but this one could far surpass earlier recommendations like Hims & Hers Health, which shot up +209%.

See Our Top Stock to Double (Plus 4 Runners Up) >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Western Digital Corporation (WDC): Free Stock Analysis Report

Sandisk Corporation (SNDK): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com