Bull of the Day: Gold.com (GOLD)

A recent pullback in Gold.com GOLD stock may be short-lived as gold prices have rebounded to new record highs of over $5,000 per ounce, as shown below, following a sharp pullback to around $4,400 per ounce earlier in the month.

Amid an unprecedented commodity price boom for various precious metals, Gold.com’s stock has been one of the market’s top performers in 2026 so far, soaring nearly +90% through the first two months of the year and recently hitting a 52-week high of $66 a share.

Offering a fully integrated alternative assets platform, sentiment continues to build for Gold.com’s outlook after reporting impressive results for its fiscal second quarter last Thursday and attracting positive attention from analysts in the process.

Headquartered in Costa Mesa, California, and formerly known as A-Mark Precious Metals, Gold.com provides an array of precious metals, including minted gold bars, silver, platinum, and palladium, along with copper bullion and numismatic coins to wholesale and retail consumers.

Image Source: TradingView

Strong Q2 Results & Strategic Expansion

Enforcing the narrative that Gold.com is executing well, Q2 sales spiked 136% year over year to a quarterly record of $6.47 billion from $2.74 billion in the comparative quarter. Net income came in at $11.6 million or adjusted earnings of $0.91 per share, a 55% increase from EPS of $0.55 in the prior year quarter.

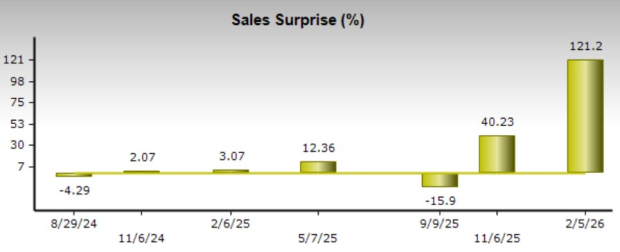

Drawing analysts' attention is that Gold.com crushed consensus sales and EPS expectations of $2.92 billion and $0.70 per share by 121.2% and 30%, respectively.

Attributing to Gold.com’s compelling expansion is its international growth, with its wholly owned subsidiary, LPM Group Limited, being based in Hong Kong and becoming one of the largest precious metals dealers in Asia.

LPM also has an expanding presence in Singapore, with it noteworthy that Gold.com acquired Monex Deposit Company in January, an established U.S. precious metal dealer that should significantly expand its product offerings and customer base as well. Furthermore, management emphasized ongoing efforts to integrate acquisitions and optimize costs to maintain long-term margin expansion.

Image Source: Zacks Investment Research

Favorable EPS Revisions & P/E Valuation

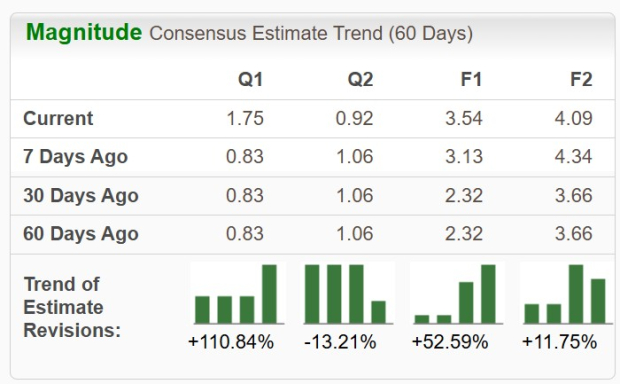

Supportive of more upside in GOLD shares is that Gold.com’s fiscal 2026 EPS estimates have spiked over 50% in the last 60 days, with FY27 EPS revisions still up nearly 12%.

Within the last week, FY26 EPS estimates have risen 13% despite a 5% decline in FY27 EPS revisions. Gold.com’s EPS is now expected to soar 63% this year and is projected rise another 15% in FY27 to $4.09.

Image Source: Zacks Investment Research

Making Gold.com’s EPS outlook more attractive is that GOLD still trades at a reasonable 22X forward earnings multiple, offering a slight discount to the benchmark S&P 500 amid heavy market interest.

Image Source: Zacks Investment Research

Conclusion

As a beneficiary of sky-high gold prices and other booming precious metals, Gold.com’s rebranding couldn’t have come at a better time, cleverly changing its ticker symbol from ARMK to GOLD in December.

But as the company has stated, “This transition represents far more than a name change. It encapsulates our corporate identity as the most trusted and globally recognized precious metals platform, and our commitment to delivering value for our customers, partners, and, of course, our shareholders.”

With now appearing to be an ideal time to invest in Gold.com stock based on a pleasant trend of positive EPS revisions, its Zacks Rank #1 (Strong Buy) rating is further supported by an overall “A” Zacks Style Scores grade for the combination of Value, Growth, and Momentum.

Zacks' Research Chief Picks Stock Most Likely to "At Least Double"

Our experts have revealed their Top 5 recommendations with money-doubling potential – and Director of Research Sheraz Mian believes one is superior to the others. Of course, all our picks aren’t winners but this one could far surpass earlier recommendations like Hims & Hers Health, which shot up +209%.

See Our Top Stock to Double (Plus 4 Runners Up) >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gold.com Inc. (GOLD): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com